- Email us: sales@msbdocs.com

Banks and paperwork have always gone hand in hand! Your extensive documentation now deserves smart management! Digitize your workflows with MSB Docs and manage your overwhelming paperwork requirements with utmost ease and efficiency. From new account openings to data entry, loan approvals, deposits management and many more, we automate all your signing and documentation processes to lend you an edge.

eSignatures increase the document turnaround times by 25 times and enhance customer satisfaction rates by 127%.

Digital, paper-free onboarding facilitates quick account opening by clients, which further accelerates new customer acquisition rates by 58%.

Digital workflows streamline banking operations, thereby increasing operational efficiency by 64%.

We are committed to drive the change that you desire. Our specially curated solutions for the banking industry extend beyond document management, and enable you to operate and serve your banking customers smartly and efficiently.

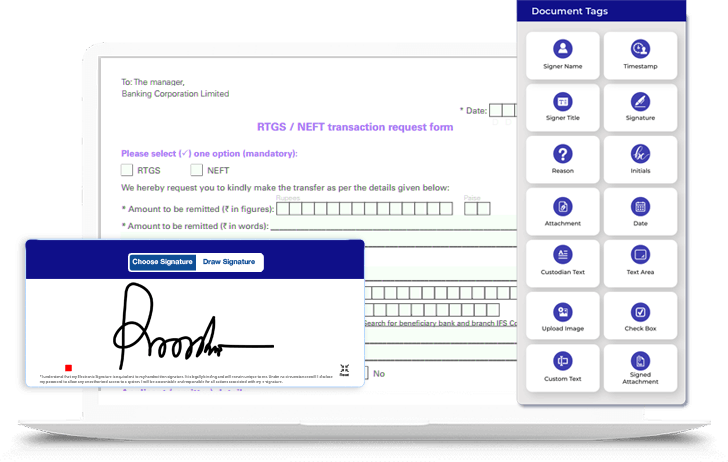

Replace your manual document signing processes with our advanced, legally binding electronic and digital signatures. Right from account opening to loan approvals, lending, wealth management and many more, accelerate your signing and approval processes to deliver efficient banking services round the clock.

Automate your banking document workflows within minutes to optimize operations and improve efficiency. Standardize your banking processes with our user-friendly workflow templates. Choose and create your own templates to suit your bank’s distinct requirements.

Categorize all your banking documents by using our smart digital tags. Have your documents securely stored in a central cloud repository and experience easy search and retrievability.

Overcome the limitations of paper-based forms and move the digital way with MSB Docs. Our smart and simplified web forms validate and capture all your business-critical data automatically, thus offering you a seamless and superior form-filling experience.

Automate the KYC verification process for your customers with our enhanced Video-in-person verification (VIPV) feature. Save time as your customers’ ID verification process gets completed virtually, eliminating the need for conducting an extensive in-person verification process.

Give your modern banking customers what they demand – quick, efficient services. Raise the bar of your customer experience by having your signing and documentation requirements in complete control.

Smart automation eliminates the chances of processing errors and ensures greater accuracy of results. A stringent ID verification process safeguards all your banking documents and transactions against any unauthorized access.

Enhanced safety measures such as world-class encryption, tamper-proof storage, detailed audit trails, multi-factor authentication, etc ensures topmost security and regulatory compliance for all your critical data.